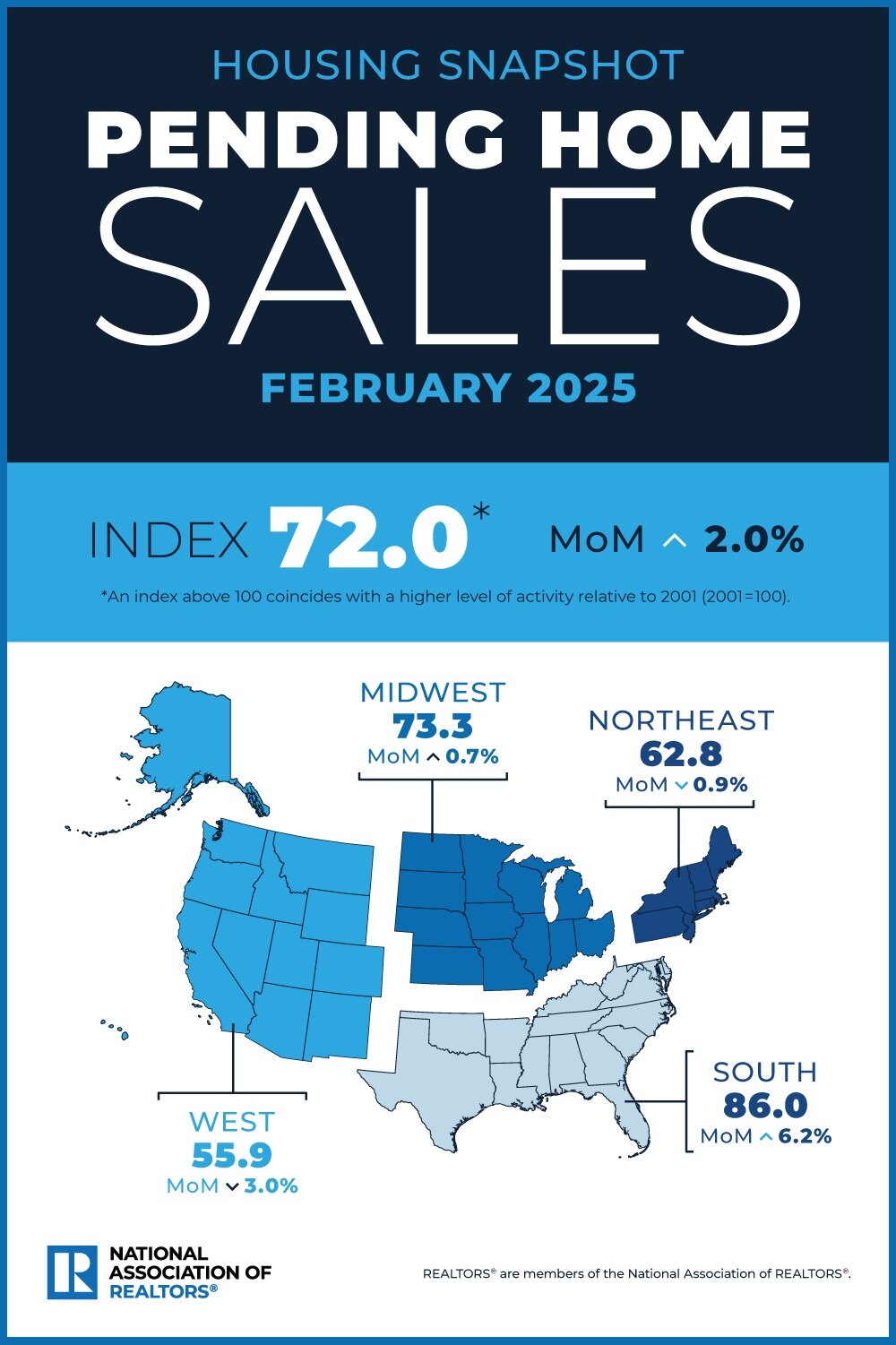

Pending home sales rose by 2.0% in February 2025, according to the National Association of Realtors (NAR). Regional performance varied, with the Midwest and South posting gains, while the Northeast and West experienced month-over-month declines, the latter seeing a steeper drop. However, on a year-over-year basis, all four regions reported declines in contract signings, with the Midwest seeing the largest reduction.

The Pending Home Sales Index (PHSI), a key forward-looking measure based on contract signings, increased to 72.0 in February, reflecting a 2.0% monthly rise. Compared to February 2024, pending transactions fell by 3.6%. An index reading of 100 corresponds to the level of contract activity in 2001.

“Although contract signings saw a slight monthly uptick, they remain significantly below historical norms,” said Lawrence Yun, NAR Chief Economist. “A notable drop in mortgage rates could enhance both demand and supply–by improving affordability and reducing the mortgage rate lock-in effect.”

NAR Quarterly Economic Forecast

Yun noted that the Federal Reserve’s outlook for slower economic growth suggests a moderate decline in mortgage rates. “However, the high national debt will likely prevent rates from dropping sharply, keeping them well above the 4%-5% range seen during President Trump’s first term,” Yun added.

NAR projects mortgage rates will average 6.4% in 2025 and decrease slightly to 6.1% in 2026. Existing-home sales are expected to rise by 6% in 2025, with an additional 11% growth anticipated in 2026. In the new-home market, where inventory remains ample, sales are forecasted to climb by 10% in 2025 and another 5% in 2026. The national median home price is projected to grow by 3% in 2025 and 4% in 2026.

“As more supply enters the market, home price growth will moderate,” Yun said. “Rising incomes and wages outpacing home price increases would be a positive development for affordability.”

For the latest projections, view NAR’s Nationwide Forecast as of March 2025. The latest quarterly economic forecasts are available online under Research and Statistics in the “Latest Housing Indicators” section.

Regional Breakdown of Pending Home Sales

- Northeast: The PHSI slipped 0.9% to 62.8 in February, down 2.5% from a year ago.

- Midwest: The index edged up 0.7% to 73.3 but was 4.7% lower than in February 2024.

- South: February saw a robust 6.2% increase to 86.0, though the index remained 3.4% below last year’s level.

- West: The PHSI dropped 3.0% to 55.9 in February, marking a 3.5% decline year-over-year.

These regional insights highlight the varying dynamics across U.S. housing markets as they adjust to shifting economic conditions.