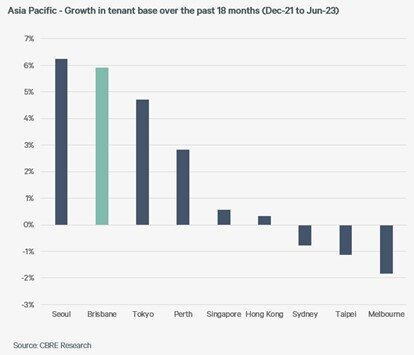

According to new CBRE data, Brisbane has emerged as an Asia Pacific leader in the office leasing stakes, ranking second only to Seoul when it comes to growth in the city’s tenancy base over the past 18 months.

In a new report, CBRE highlights that a robust return to the office coupled with a solid economic backdrop has led to 5.9% growth in the Brisbane CBD’s tenant base since the end of 2021.

While Seoul has led the pack in this regard, with 6.2% growth, Brisbane’s was a close second, trailed by markets like Tokyo (+4.7%), Perth (+2.8%), Singapore (+0.6%) and Hong Kong (+0.3%).

In contrast, the tenant bases of Sydney and Melbourne contracted over the same period by 0.8% and 1.8% respectively.

“The dominant occupiers in Brisbane are government, resources and engineering companies, which are increasing their workforce and absorbing additional office space to cater for both immediate and long-term growth,” said CBRE’s Queensland State Director of Office Leasing Chris Butters.

“The other major market theme is the overarching demand for prime grade office accommodation, as active organizations focus on improving both their quality of premises and on-floor workplace environments. Looking forward to the second half of 2023, we anticipate that Brisbane’s vacancy levels will contract further with no new supply scheduled to enter the market.”

CBRE’s report points to a solid return to office in Brisbane, with occupancy on peak days (typically Tuesday-Thursday) almost at pre-COVID levels.

In addition, larger corporations occupying more than 3,000sqm of space have typically kept the same footprint or expanded when reassessing office requirements.

CBRE’s Head of Office Research Tom Broderick noted, “This is different to markets like Sydney and Melbourne, where physical occupancy has been lower, which has led the major banks and other bigger organizations to contract their footprint.”

“Brisbane has also benefited from government occupiers at both a State and Federal level being particularly active in H1 2023, and typically looked to upgrade their office accommodation, which is causing the prime grade market to tighten,” Mr. Broderick added.

CBRE’s research has been released following the launch of the Property Council of Australia Office Market Report, which singled out Brisbane as the only CBD market in Australia where vacancy dropped over the past 18 months.

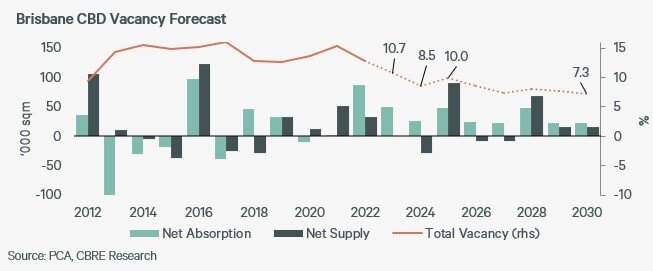

At the end of 2021, total vacancy in Brisbane was 15.4% and this has now tightened to 11.6%, following strong net absorption of 116,000sqm over that 18-month period.

Sydney and Melbourne observed an increase in vacancies of over 2 percentage points in that time period as tenants contracted.

Moving forward, Brisbane is facing a continued supply gap with no new office buildings being delivered until early 2025. This will drive the CBD vacancy rate lower, with CBRE’s base case being 8.5% by the end of 2024 – giving the city its first sub 10% vacancy rate since late 2012.

“The city’s tightening vacancy is already impacting on prime rents, with our data highlighting 5.0% gross face rental growth over the past 12 months. This trend is likely to continue as large contiguous space in the market is absorbed and vacancies tighten further,” Mr. Broderick said.