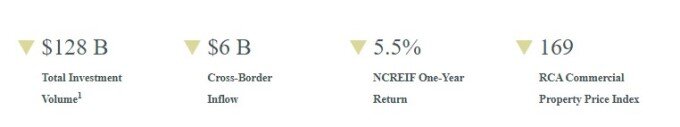

CBRE is reporting this week that U.S. commercial real estate investment volume fell by 63% year-over-year in Q4 2022 to $128 billion. For the year, volume fell by 17% to $671 billion from 2021’s record level but was the second highest on record.

Multifamily was the leading sector with $48 billion in Q4 volume, followed by industrial & logistics with $32 billion and office with $19 billion, says CBRE.

On a trailing-four-quarter basis, Los Angeles was the top market with $53 billion in volume, followed by New York with $51 billion.

Institutional and private investors were net buyers in Q4, while REITs and cross-border investors were net sellers.

CBRE also reports inbound cross-border investment decreased by 81% year-over-year in Q4 to $6.2 billion due to the strong U.S. dollar and economic uncertainty.